The Impact of Tariffs on the Finance Job Market

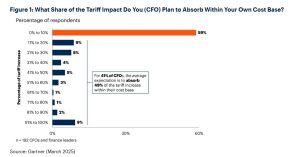

A recent analysis from Gartner highlights a growing trend among Chief Financial Officers (CFOs) in response to new tariffs. According to the report of 192 CFOs and finance leaders across industries with global operations, 59% of respondents expect to absorb less than 10% (graph 1) of tariff-related cost increases within their cost base. This shift in pricing strategy reflects the broader economic challenge of balancing profitability with market competitiveness.

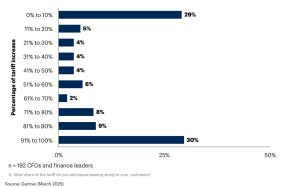

The planned response to tariffs by CFOs is most noticeable in the potential impact to customers, where 30% of respondents are planning to pass 91%-100% of tariff costs, where as an almost identical number expect to pass on little to no additional cost to consumers, demonstrating a real divergence of opinion on how to manage the bottom-line vs how to retain a customer base. (graph 2).

Implications for the Finance Job Market

The introduction of new tariffs presents significant challenges for finance professionals, requiring them to adapt to evolving global trade policies and economic conditions. Key areas of impact include:

- Strategic Pricing and Cost Management – Commercial finance teams will play a crucial role in determining how organisations adjust pricing strategies in response to tariffs. This requires a deep understanding of cost structures, supply chain expenses, and consumer demand elasticity.

- Enhanced Financial Planning & Analysis (FP&A) – With tariffs introducing economic uncertainty, finance professionals with strong forecasting and scenario-planning capabilities will be in high demand. Businesses will rely on financial experts to assess the long-term effects of tariffs on revenue and profitability.

- Supply Chain Financial Analysis – As companies seek alternative sourcing strategies or renegotiate supplier contracts, finance professionals must evaluate the financial feasibility of these changes. Understanding global trade regulations and supply chain cost structures will become increasingly valuable.

Adapting to the Changing Landscape

To navigate these challenges, finance professionals should focus on:

- Continuous Skill Development – Keeping up-to-date with international trade policies, economic trends, and financial modelling techniques will be essential. Professionals who develop expertise in trade finance and tariff impact assessment will be well-positioned for new opportunities.

- Collaboration Across Departments – Working closely with supply chain, procurement and commercial teams will enable finance professionals to provide strategic insights that help businesses mitigate the impact of likely tariffs.

- Leveraging Data & Technology – The use of advanced financial modelling tools and analytics will be key to making informed decisions in a volatile trade environment. Finance teams must embrace digital transformation to stay ahead.

At Cedar, we recognise that the evolving global trade landscape will continue to shape the finance job market. As tariffs and regulatory changes influence business strategies, finance professionals with the right skill set will be more valuable than ever.

For organisations looking to strengthen their finance teams, you can send us your job vacancy here.

For finance professionals seeking new opportunities, get in touch with our team here.