Automate, Automate, Automate – What’s stopping you?

Yes, corny, I know, but no less true. The only thing that is probably stopping you automating your finance function, assuming you haven’t already begun work on this, is you.

Based on my conversations with clients many have, but many more haven’t (yet) – AI is a slowly building tsunami that is beginning to sweep throughout our economy. How best to ride the wave, avoid the inevitable snake-oil salesmen whilst deciding what is going to work and add real value to your organisation is, increasingly, a topic for deep debate amongst the C-suite.

For finance, it’s not just a question of whether you should make more use of automation, it’s a question of how and when, with affordability obviously being a major factor. The question is also what benefits can be derived from a root-and-branch study of how the application of automated processes can impact your business.

I’m not revealing any secrets if I say that relationships between finance and other departments – both internal and external – can be fraught. Consequently, the need to improve the customer experience often underpins the drive for transformation by finance. By making systems work to the benefit of their ‘customers,’ finance teams can improve their standing and influence at every level of the operation.

That said, the principal benefit of intelligent automation is in the way it allows finance to offer greater value to the rest of the business. Traditionally, finance is seen as “the bean counters” – the people who know the price of everything but the value of nothing. Unfair? Absolutely, but… what if you are simply managing lots of numbers but not drawing any insights? The monthly eyeball with the local manager over her or his P&L often has an expectation that the business head will explain to finance the reasons behind the numbers. How much better is it for finance to be able to first gain meaningful insights from the data as opposed to having data just sitting there seeking an explanation?

According to a recent US report, “77% of finance organisations believe that business transformation relies on finance automation that delivers real-time data intelligence.” By data-led planning and analysis, finance can provide insights that help save money and tell business managers where and when to spend more effectively.

Put more directly, the adoption of technology that delivers real-time insight into current performance as well as granular analysis of future trends and opportunities is essential if you don’t want to be left behind. As mentioned above it also comes with the added benefit that it can also provoke a genuine cultural shift where finance is not seen (as it is by some) as a business prevention device but rather a willing partner in maximising returns and cross-company prosperity.

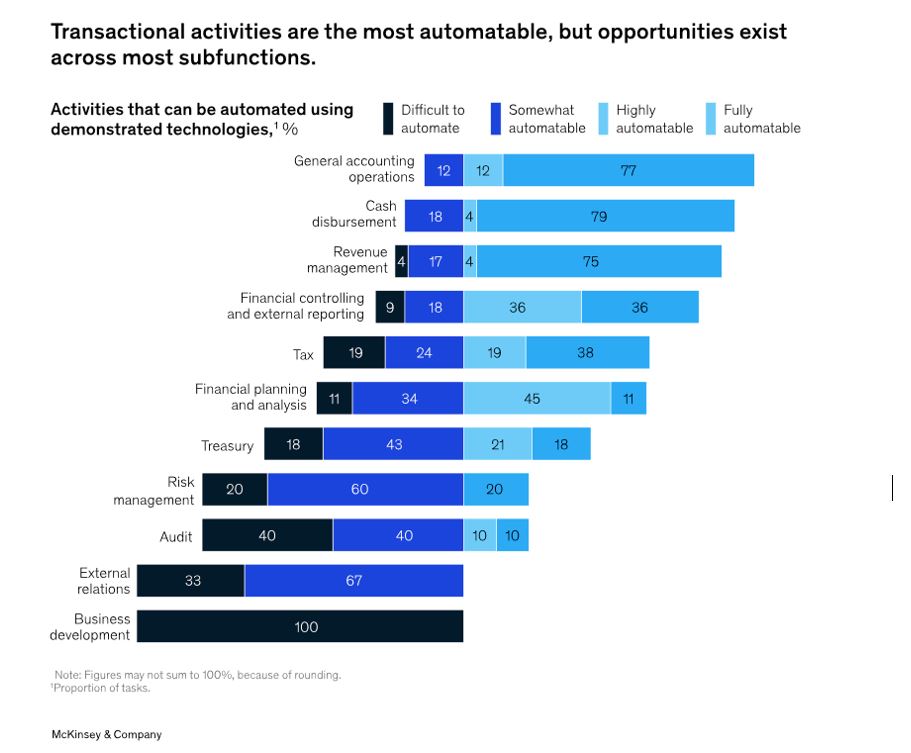

The scope is immense. A recent McKinsey report on technology and the future of finance came up with a chart (reproduced below) showing each major area of finance and how easy or difficult it might be to automate.

For some organisations, the first challenge is knowing where to begin. I mentioned affordability previously. Yes, of course, automating your finance processes costs money. It’s easier to be a trailblazer if you’re one of the bigger businesses. But that doesn’t mean SMEs can’t get involved, starting on a smaller scale; perhaps something as simple as enhanced systems across areas such as O2C or FP&A, better integrated into your existing systems.

There will be organisational issues and IT worries to overcome. IT will ask, “do you know how much ongoing maintenance will cost?” The obvious answer: “we’re finance, we know how much everything costs,” may be factually correct, but it’s not the way to win friends and influence people. A sound relationship between the CFO and CTO is a prerequisite, as is getting in an experienced Transformation Lead who can work with the business to drive initiatives forward. I’m not saying this is going to be easy; change never is.

Sometimes, the decision is not to proceed, but that doesn’t mean the exercise is worthless. The McKinsey report cited the example of a global pharma company that had outsourced its P2P finance activities. After assessing the costs of bringing this in-house, they challenged the outsourcer to prove it could compete with an automated model. At the end of the project, it was decided not to move from the outsourced model to an automated in-house one, but they did renegotiate the outsourcer’s contract, saving at least 40% over the next three years. For a global company, that’s a lot of money, but similar percentage savings are perfectly possible for smaller firms too.

I said at the outset that the wave of new technology is washing over us all. Finance must ride the crest of this wave, not stumble and be left behind.